Peso Cost Averaging Philippines: A Definitive Guide

This article will provide you an in-depth guide about Peso Cost Averaging, one of the stock investment techniques frequently used by Pinoy investors with good results.

Peso Cost Averaging (also known as PCA), is a highly effective strategy recommended by many stock investors in the Philippine Stock Exchange. This is because PCA is simple to grasp and implement and can be started with relatively less capital.

Chances are, you’ve come across this investing approach in the past but haven’t fully understood how it actually works. Good news, everything you need to know about the said technique can be found in this article.

What Is Peso-Cost Averaging?

Peso-cost averaging involves the gradual purchase of stocks, using a fixed amount of money at regular intervals. Instead of investing a lumpsum amount, the investor makes monthly ‘installments’ in selected stocks regardless of the current price of those stocks.

A good example of this is an investor who allocates Php 5,000 per month to invest in the stock market. Regardless of the prices of the shares available in the market in a particular month, the investor will put his or her Php 5,000 in the specific stocks that he/she has chosen.

The goal of the cost averaging strategy is to minimize the possibility of losses and getting a lower average purchase price on the stocks being bought. It is an almost guaranteed way to make money from the Philippine Stock Exchange over the course of several years.

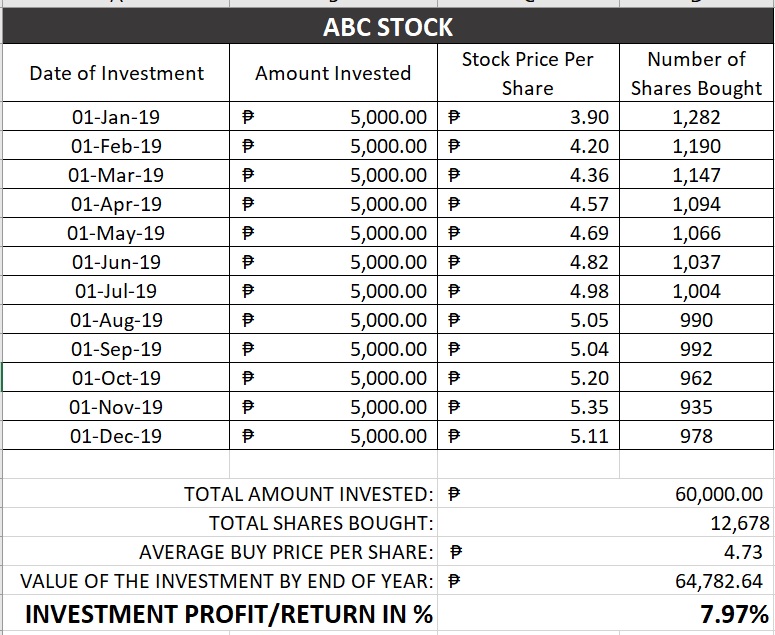

Still sounds a bit confusing? Here’s an example chart of a peso-cost averaging strategy over the course of one year:

Peso Cost Averaging Example

As seen in the example above, an amount of Php 5,000 was invested in ABC stock per month, at different prices per share. (ABC is a fictional Pinoy stock which is only for illustrative purposes).

Some months, the Php 5,000 investment can buy lots of shares, while in other months, it can only buy fewer shares.

The total amount of ABC shares bought within the year is 12,678 shares.

But instead of buying those 12,678 shares in one go at the stock’s year end price of Php 5.11 per share, the investor was able buy them at an average price of Php 4.73!

How? By buying at multiple price points over the course of a year and automatically “averaging out” those costs!

By doing this method, the investor was able to turn Php 60,000 into Php 64.782.64, or a return of 7.97%.

Imagine if you have a million pesos in capital instead, and you earned a 7.97% return. That’s Php 79,700 in additional passive income for you.

Bottomline is, if you buy stocks regularly at a fixed amount, you’ll be able to average out your losses in the long term and gain more stock profits in the process.

What Investing Experts Say About Cost Averaging

Peso-cost averaging (or simply ‘cost averaging’ in other countries that don’t use peso as a currency) has been hailed by investing experts worldwide as a viable and highly effective strategy.

For example, Benjamin Graham, the mentor of world-famous investor Warren Buffett, had this to say about peso (dollar) cost averaging:

“No one has yet discovered any other formula for investing which can be used with so much confidence of ultimate success, regardless of what may happen to security prices, as dollar-cost averaging.”

– Benjamin Graham, from his book, The Intelligent Investor

Bo Sanchez, one of the leading Filipino investors and authors who popularized stock investing to the mainstream Filipino crowd, wrote this in his book My Maid Invests In The Stock Market:

“If you want to invest in the stock market, there’s only one choice: Money Cost Averaging. That’s just a fancy name for buying stocks of great companies, little by little, each month.”

– Bo Sanchez, from his book, My Maid Invests In The Stock Market

NOTE: Though I personally believe that there are many other profitable ways to invest in the stock market, I agree that Peso Cost Averaging is one of the best long-term strategies available out there. I know because I’ve personally tried this and experienced great results.

Why Perform Peso-Cost Averaging?

So why should you try the PCA method? Let’s outline the main reasons why it is a very effective and profitable long-term strategy.

Here are its main advantages:

Peso Cost Averaging Minimizes Your Risk

When buying stocks at different price points, you minimize the risk of accumulating permanent losses each time you buy a stock that goes down in value.

You are not pressuring yourself to win a trade with just one purchase. Instead, you present yourself with different opportunities to buy a quality stock.

How does PCA decrease your risk exposure? Simple! It helps you have that long-term mentality. And historically, people who invest in the stock market for the long term, eventually win!

It Allows You to Buy Shares At a Lower Average Price

Let’s say you bought a stock at 10 pesos per share, and soon after that, the price went down to 6 pesos per share. If you’re a trader buying at just one price point (10 pesos), you would have instantly incurred a 40% loss!

However, if you’re doing Peso Cost Averaging, you wouldn’t be worried about that decline in price.

When it’s time for you to invest in a particular month, you would just buy the stock at whatever lower price it’s currently in (6 pesos per share). Then you’d be able to pull down your average buy price to a lower figure. When the price returns to its old price of 10, you will earn a profit.

It’s Better Than Keeping Your Money In A Piggy Bank

Just how much will your money grow if you kept in a piggy bank for years? You guessed it, none! If you decide to keep it in a real bank savings account, you’d be lucky to earn 1% in annual interest.

Money invested in the stock market through a peso-cost averaging strategy has the greater chance to grow over the following months or years. There may be no guarantees or fixed interest payments, but you’ll enjoy greater potential with your money.

It’s Safer Than Day Trading

Day traders are those who ‘invest’ in the stock market daily, tracking price charts and making multiple buy and sell transactions per day. While it may sound exciting (exhausting in my opinion), day trading is a very risky way to make money from stocks.

Not only do day traders spend more money on transaction fees, the possibility of winning and losing it all in a single day is very real. Similar to losing money in the casino, the house (market) always wins!

With a peso cost averaging strategy, however, you are spreading your risk over a long period of time. You are also gradually putting your money in the market, so you enjoy a stronger hedge of protection over market downturns and declines.

It’s A Good Way To Prepare For Retirement

Funds that are invested and grown via cost averaging method can be used as a retirement fund in your twilight years. Yes, that’s right. Retirement.

While majority of the working population are leaving their retirement in the hands of their bosses, their insurance agents, or social security installments, it is much better to be proactive about this matter and have more control over your retirement funds.

At the end of the day, no one will take better care of you than yourself and your family. So why put your full trust on your banker or the government to take care of you when you get old?

Money saved from your income every month and invested in the Philippine stock market can serve as your seed for the future. So the earlier you start peso cost averaging, the better!

It Disciplines You To Save

This is probably the best thing about the PCA stock market approach. It encourages you to save money and do so on schedule. And it doesn’t have to be huge amounts of money. You can start with Php 1,000 a month. Once you develop the habit of setting aside money every month to invest, you can then increase your monthly investments.

Peso-cost averaging is the easiest investment method to start for any aspiring investor in Philippine stocks. It’s just Saving Money 2.0, but with a higher potential to earn a profit from the money that you save.

The Disadvantages of Peso-Cost Averaging

Of course there are always two sides to the coin. We’ve mentioned the good points of applying the PCA strategy in the Philippine setting. But I would be a liar if I told you that there are no disadvantages. In fact, there are several disadvantages and here are they:

It Is A Long-Term Strategy

Yes, this is the main benefit of PCA but it is also the greatest disadvantage. It takes time to build substantial profits from a cost averaging method. It could take at least 5 years to several decades before you can build up some considerable funds and returns that you can use to have a better quality of life.

PCA is the ultimate bummer. It is one of the risk-free methods of investing in Philippine stocks, but you will need to use a huge portion of your life to wait for its rewards. The temptation to use the money in emergency situations is very real. Also, if you get impatient, you might end up re-allocating money to other forms of assets or investments.

Gains Are Potentially Lower Than Other Aggressive Investing Strategies

Some even go as far as arguing that Peso Cost Averaging is only for those who want to play it safe and are “too afraid”. Well, there is some degree of truth to that. A recent study made about S&P 500 stocks showed that “During 1926 through 2011, lump sum investing won the performance race [over cost averaging method] 67 percent of the time during rolling 10-year periods.”

So while cost averaging is safer than other strategies that need lumpsum funds, it’s performance is also not that exceptional. You can expect average returns from it over a long period of time. Outperforming other investing methods is just a bonus in case it happens.

Inflation Will Eat Up A Large Portion Of Your Gains

As in any other long-term strategy, the greatest enemy is that thing called ‘inflation’. Inflation is the rate in which the value of money erodes. In the Philippines, this ranges from 2% to 3% per year (with a recent high of 5.2% in 2018).

This means, even if you generate a 10% annualized return from your investment using a Peso Cost Averaging method, around 3% to 4% of that will be eaten up by inflation PER YEAR. Not a good thing.

Unfortunately, inflation can’t be avoided and should be part of the overall consideration whenever you are investing.

Higher Possibility Of Short Term Losses

Peso cost averaging is not exempt from the possibility of short-term losses. In fact, there is a greater possibility that you will experience some paper losses within the next year or two. However, as time rolls on and you consistently use this strategy, only then will you experience its long-term benefits.

That’s why it’s important to set your expectations when using this strategy. Expect some paper losses early on, but keep on keeping on anyway. Time has a way of making anything grow.

How To Get Started With Peso-Cost Averaging

Compared to other lumpsum forms of investing, peso cost averaging is very easy to start. Here are some of your options:

- COL Financial Easy Investment Program – COL Financial is a well-known stock brokerage in the Philippines that helps Filipinos invest in the stock market through the internet. They have an investment program that uses the peso cost averaging method, also known as the Easy Investment Program (EIP). In the program, you will need to make fixed monthly payments that go directly into purchase of blue chip stocks in the Philippines stock market.

- Manual PCA – If you don’t want somebody else doing the investing on your behalf, you can do peso-cost averaging on your own (something which I call manual PCA). Using your stock investing account in COL Financial or First Metro Sec, you can buy stocks every month with an amount that fits your budget.

- Investing through banks – if you have a bank account that has an online banking feature, you can easily invest in stocks every month. Metrobank, Security Bank, and Chinabank, are some of the banks that allow you to invest in stocks directly from your account’s online banking feature.

How To Come Up With Funds To Invest in Stocks

If you truly want to do cost averaging and invest money that you can use for many years to come, the easiest way to get started is to get your financial house in order.

Unless you budget your monthly income, you can’t get started with peso-cost averaging because you won’t have anything to invest. And if you fail to become consistent in your investing efforts, PCA will not be possible because it requires a constant allocation of your income every month.

- Start by cutting unnecessary expenditure.

- However, don’t cut the important things in your life that you need and brings you happiness. Give yourself ample food, entertainment etc…Pay your bills, and have an adequate budget for living expenses.

- Cut the unnecessary stuff like excessive Starbucks everyday, too much dining out, luxury stuff that you can’t afford, etc.

You are making a new commitment in your life to invest in your future. So you have to be willing to make some minor sacrifices.

What Stocks Should You Cost Average?

As effective an investing strategy this may be, it simply won’t work on all kinds of stocks. For best results, you should limit your peso-cost averaging activities to these kinds of stocks:

- Blue Chip Stocks. These are popular stocks in the market whose companies are well known brand names nationwide. The idea behind gradual buying of blue-chip stocks is that there is a higher chance that these companies would still be around a decade or so from now.

- Stocks In The PSEI Index. These are the 30 best blue-chip stocks in Philippines as rated by the Philippine Stock Exchange. The PSEI index is the benchmark (the golden standard) of the entire Philippine Stock Exchange, and usually if the PSEI performs well or disappoints, the entire market will follow suit.

- Growth Stocks. Some stocks are not part of the PSEI index but are showing great strides of consistent growth over the past few weeks, months and years. You can decide to include a few of these in your peso cost averaging portfolio if you want (of course, after carefully studying them).

- Value Stocks. These stocks are proverbial 100 peso bills selling for 50 peso bills. In other words, they have a high intrinsic value but they are selling for cheap. Undervalued stocks should comprise a great portion of your portfolio if you want to earn above average profits in the stock market every year.

Things To Avoid When Peso-Cost Averaging

Avoid Being Impatient

You must understand that you will not earn a considerable amount of profit overnight. In fact, you may even experience substantial paper losses over the short to medium term. Keep your expectations in check and you will have no problems using this investing method.

Lack of Consistency

For your cost averaging to work, you need to faithfully allocate funds every month to your investment account. Buying additional stocks every month with the same peso amount should become a habit. Erratic buying should be avoided at all costs.

Getting Sidetracked by Shiny Objects

Some people start investing consistently for a short period of time, then after a few months they get bored and put their money somewhere else. Usually, they invest their money in hot speculative stocks and cryptocurrencies, because these appear more alluring.

If you really want to invest in shiny objects, do that without abandoning your peso-cost averaging strategy. Allocate a separate budget for speculative stocks but keep you long term portfolio intact.

Panic Selling When Stocks Go Down

A lot of ‘investors’ lose their cool when there is a trading day with a huge decline. This can happen during economic crises, bad market news locally and internationally, and political conflicts. In majority of cases, the dip in stocks are TEMPORARY. However, many investors make it PERMANENT by selling their stocks and forever losing the chance to make a profit from the money they invested.

Not Being Diversified Enough

To decrease your chances of losing money on your investments, you need to have a diversified portfolio. You can do this by gradually buying one stock at a time, then aim to have at least 10 to 30 different stocks. That’s a lot of money to invest, but if you do for the long term, you can eventually build a solid portfolio with a good average price per share.

Books and Online Resources About Peso-Cost Averaging

- My Maid Invests In The Stock Market, by Bo Sanchez. This book popularized peso-cost averaging in the Philippines in the early 2000s, and will provide you a good foundation on how to get started with investing.

- The Intelligent Investor, by Benjamin Graham. This book is considered the “bible” of value investing. The book supports the idea of buying stocks gradually over time, but on top of that, it helps you select the best stocks to buy.

- Pinoy Power Investing, by Verniel Cutar. This recently published digital book will show proven strategies on how to outperform the market and earn above average returns. Peso-cost averaging is just ONE of the basic strategies involved, but there are more than a dozen others (such as the Monthly Bargain Stock Approach, The 5-Step Stock Selection Criteria, and many more).

Is Peso-Cost Averaging A Good Investment Strategy?

Peso-cost averaging is a solid and safe strategy for beginner investors. especially those who don’t have time to monitor their portfolio. However it takes a while to make money and the investment horizon is 10-15 years.

If you want to outperform the market with an investment horizon of 6-12 months, there are other safe investing strategies you can try. Let me show you the simple strategy that helped me earn a stock portfolio return of 22. 79% in 11 months.

You can learn more by availing of this free 5-day email course about investing in stocks.